Your Balance Sheet

What is a Balance Sheet and why do I need it anyway??

Accurate and balanced Balance Sheets are rare with users of Truckers Helper both online and in the standalone. I'm assuming that this is because very few people understand what a Balance Sheet is and how to keep it accurate and working. In this section we'll cover how to set up your Balance Sheet as part of the initial program set up process. In an article we'll talk about keeping it balanced and it's value. If you want to keep a Balance Sheet, and we strongly recommend that you do, please take a minute to read this section. We also have a short article available on the differences between a Balance Sheet and your P&L (Profit & Loss) statement. Understanding the differences might help you understand why it's a good idea to keep a Balance Sheet. See the articles section, Understanding Balance Sheet vs Profit & Loss

WHAT IS A BALANCE SHEET? A Balance Sheet is one of the major financial reports for your business. It provides a snapshot of the financial health of your business on a certain date. If you ever need to apply for a loan you will need a Balance Sheet as well as a Profit & Loss (P&L) statement for the bank or other lender. A Balance Sheet summarizes your Assets Liabilities and Owner Equity. You can create a Balance Sheet at any time, but the easiest way to have it available is to set it up with your program and then use it to give you a current status report every day. We use our Balance Sheet as a way to check the validity of our entries on a day to day basis. It can be a valuable tool for helping you keep your books accurate and balanced.

Whether you are starting a new company or just starting to use Truckers Helper Online for an established company the process will be essentially the same. You need to start by setting up your accounts, your assets and your liabilities. There are two ways to go about this and we'll discuss both here. The first method is the one that we have used in the past and is probably the easiest as long as you have your starting balances available as you are setting up the books. The second method will also work and is a little more detailed than the first.

NOTE: FOR THE FIRST METHOD TO WORK YOU MUST SETUP YOUR BOOKS BEFORE YOU MAKE ANY INCOME OR EXPENSE ENTRIES IN THE PROGAM.

For method 1 you will enter all your setup information first. For our example let's say that you want to start your books on 1/1/2014. Then set up all your accounts either with a starting date of 12/31/2013 or 01/01/2014. DO NOT enter any income or any expenses on your setup date. So if you used 01/01/2014 then your first entry for income and/or expenses would be on 01/02/2014. This will give you the ability to have a starting Balance Sheet which is clean, meaning that it only contains Assets & Liabilities, there are no income or expense entries to interfere with getting a good starting balance.

In order to do this you first need to round up bank and credit card statements that will give you a valid balance on your starting date. You will also need to know the current 'book value' of all your assets and the loan balances on any liabilities that you have, both short & long term. So get all of these details together before you start. If you are starting a new company then you just need the starting balances for your accounts. If you are bringing an old company into Truckers Helper Online then print a BALANCE SHEET from your old program, or if you do not have a previous problem, you can use your tax documents for the preceding year to get the balances.

Once you have these documents together use the QUICK ENTRY in Income & Expenses to open your cash, checking, savings, charge accounts and long term liabilities. For trucks we suggest using the Financial Details section when you setup your trucks and then answer YES when it asks if you want it to create the Liability account. This will create both the ASSET based on the Purchase Price you enter and the liability. If you need to adjust the Asset account you can do so with the entry the program creates for you by changing the opening balance.

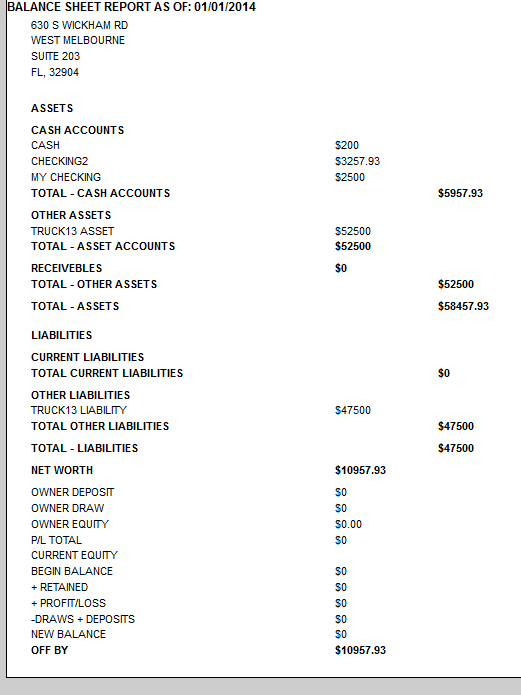

Once you have everything entered for your start up books you will run a Balance Sheet for the date of your start up entries. That Balance Sheet will be out of balance, this is normal at this point.

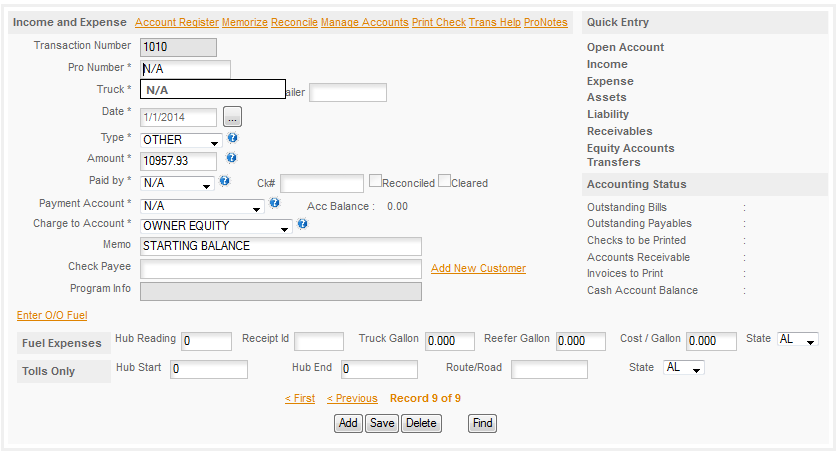

The next step if to make an OWNER EQUITY entry to show this balance as the Owner Equity. So next you will go to Income & Expenses click ADD and enter the follow entry, substituting your numbers for the ones in this entry. Be sure to use OTHER for this type of transaction.

Once you have this entry generated go back to REPORTS/ACCOUNTING/BALANCE SHEET. This time one of two things will occur.

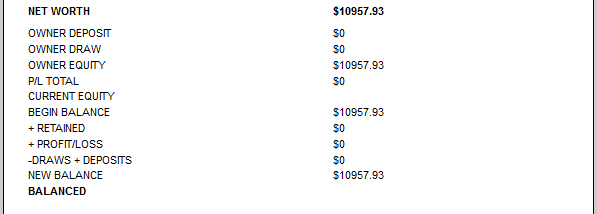

1. The account will be balanced - here's the bottom of the new Balance Sheet showing as BALANCED

Or 2. The account will be out of balance still but the OUT OF BALANCE amount will be the SAME as the NET WORTH. The difference will be either positive or negative and you'll need to change the sign to get it to balance. So if the amount is right but the Out Of Balance is still displayed go back to Income & Expenses and change the sign in front of the amount you entered. (to edit the entry just change the sign and click SAVE. The program will then tell you whether it Saved the record or if there was a problem, what the problem is).

METHOD 2

The second method is to open everything with a zero balance. You then transfer money as an OWNER DEPOSIT to enter all the Assets and enter the outstanding balances for all the liabilities or deposit cash for payments that have been made (again as Owner Deposit) and then spend that cash to get the Liability down to the appropriate balance. This method is more complicated and it's not the recommended method especially if you are light on accounting experience. This method requires an understanding of accounting and the ability to make adjusting entries, etc. in order to get the opening books where you want them.